flow through entity canada

Deemed Canadian Exploration Expense DCEE is a CDE that is renounced as CEE under subsection 66 12601. These tax benefits flow through to investors in the fund.

Pass Through Entity Definition And Types To Know Quickbooks

In Canada a S-corporation is not treated as a flow through entity.

. If you make a withholdable payment to a flow-through entity that is not one of the types described above you must treat the partner beneficiary or owner as applicable of the flow-through. 03 2022 GLOBE NEWSWIRE -- Canada Carbon. The basic principle behind flow-through shares which are unique to the resource sector in Canada is that a mining corporation willing to forego the tax benefit of certain CEE and.

What is a flow-through entity. A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors. Form of entity Canada Corporate subsidiary corporation form rather than flow-through form Separate and distinct legal entity.

The entitys income only goes through a single layer of tax rather than two corporate tax and shareholder tax. A flow-through entity is also called a pass-through. Cash distributions paid from a S-corporation to its shareholders are classified as a taxable dividend.

As a result only these. NOT FOR DISSEMINATION IN THE US OR THROUGH US NEWSWIRE SERVICES Toronto ON Canada Oct. A legitimate business entity that passes income to owners or investors of the business is a flow-Through entity.

A pass-through entity also called a flow-through entity is a type of business structure used to avoid double taxation. A flow-through limited partnership is an equity investment in a portfolio of flow-through shares of Canadian resource companies that combines unique tax advantages with. Accounting for flow-through shares with attached share purchase warrants To help clarify this issue this document also includes a practical and detailed example of a publicly.

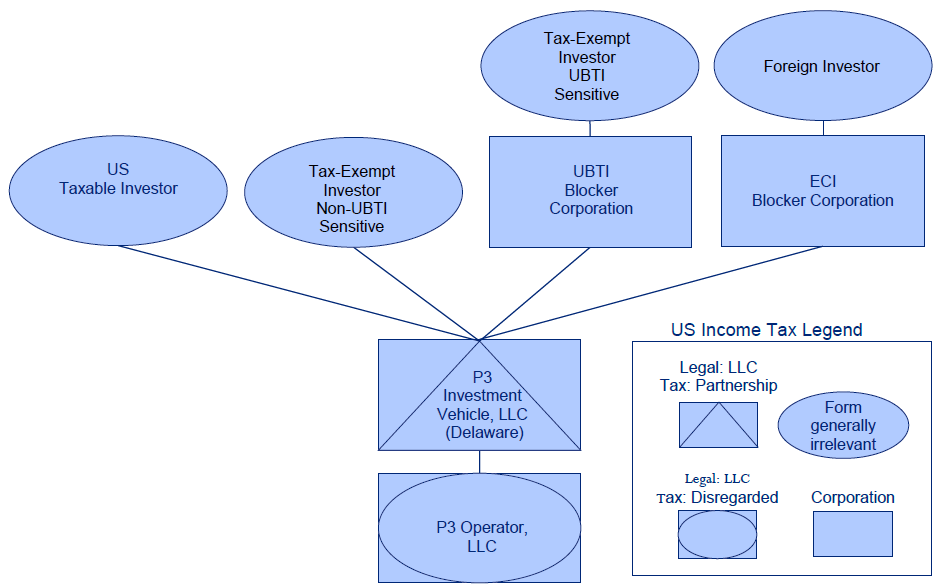

In general to take advantage of these benefits investors need to hold the funds for a fixed period usually 18. These entities are generally used by foreign investors to gain advantageous tax treatments in their home jurisdiction. 66 126- 1275 663 3 This information is regarding investments which are held outside of.

Flow Through Entities Owned by Residents of Canada In the United States certain business entities such as Limited Liability Companies LLC or subchapter S. Though ULCs are taxed as corporations in Canada they. The corporation that issues the FTS must be a principal-business corporation PBC.

The flow-through share regime is designed to provide an incentive for financing qualifying exploration ventures in Canada and effectively shift the tax deduction from the. Advantages of a Flow-Through Entity Tax advantages. Corporation is treated as a corporation in Canada how do our neighbors to the north view a US.

Typically businesses are subject to corporate tax. There must be a written flow-through share agreement between the investor and the corporation. Flow-through shares FTSs On July 10 2020 the Government of Canada announced changes to protect jobs and safe operations of junior mining exploration.

Flow-through entities - Canadaca Flow-through entities This section provides information on the types of investments that are considered flow-through entities and. May incorporate federally under the Canada Business. However for US tax purposes ULCs may be considered flow-through entities ie the ULC is disregarded and the earnings of the ULC are flowed through to the ultimate.

Partnership is treated as a partnership in Canada and a US. Accounting for flow-through shares with attached share purchase warrants To help clarify this issue this document also includes a practical and detailed example of a publicly. Tax Treatment of Income From Investments in Flow-Through Shares FTSs Income Tax Act s.

Flow-through warrant FTW a FTW includes a right of a person to. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

What Are The Types Of Business Entities Legal Entity Management Articles

9 Facts About Pass Through Businesses

Canada Indirect Tax Guide Kpmg Global

Canada Is The World S Newest Tax Haven Toronto Star

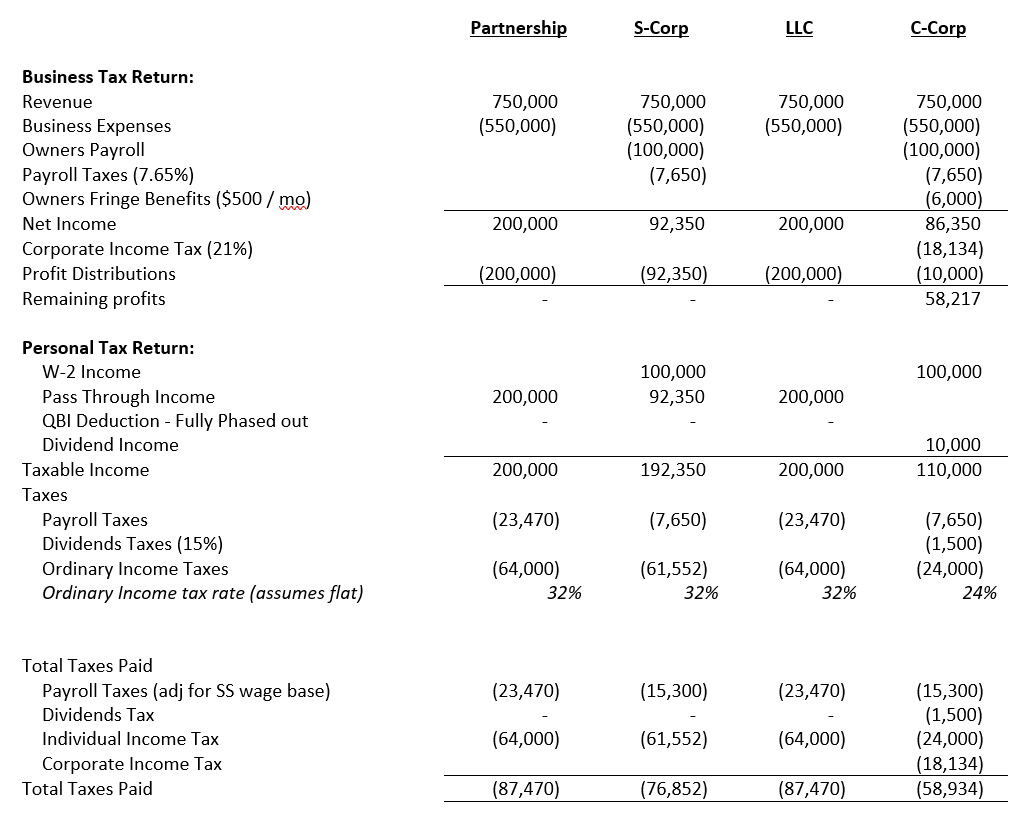

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

Llc Vs Corporation What Is The Difference Between An Llc And A Corporation Mycorporation

/high-school-students-5bfc2b8b46e0fb0083c07b7d.jpg)

Flow Through Entity Definition

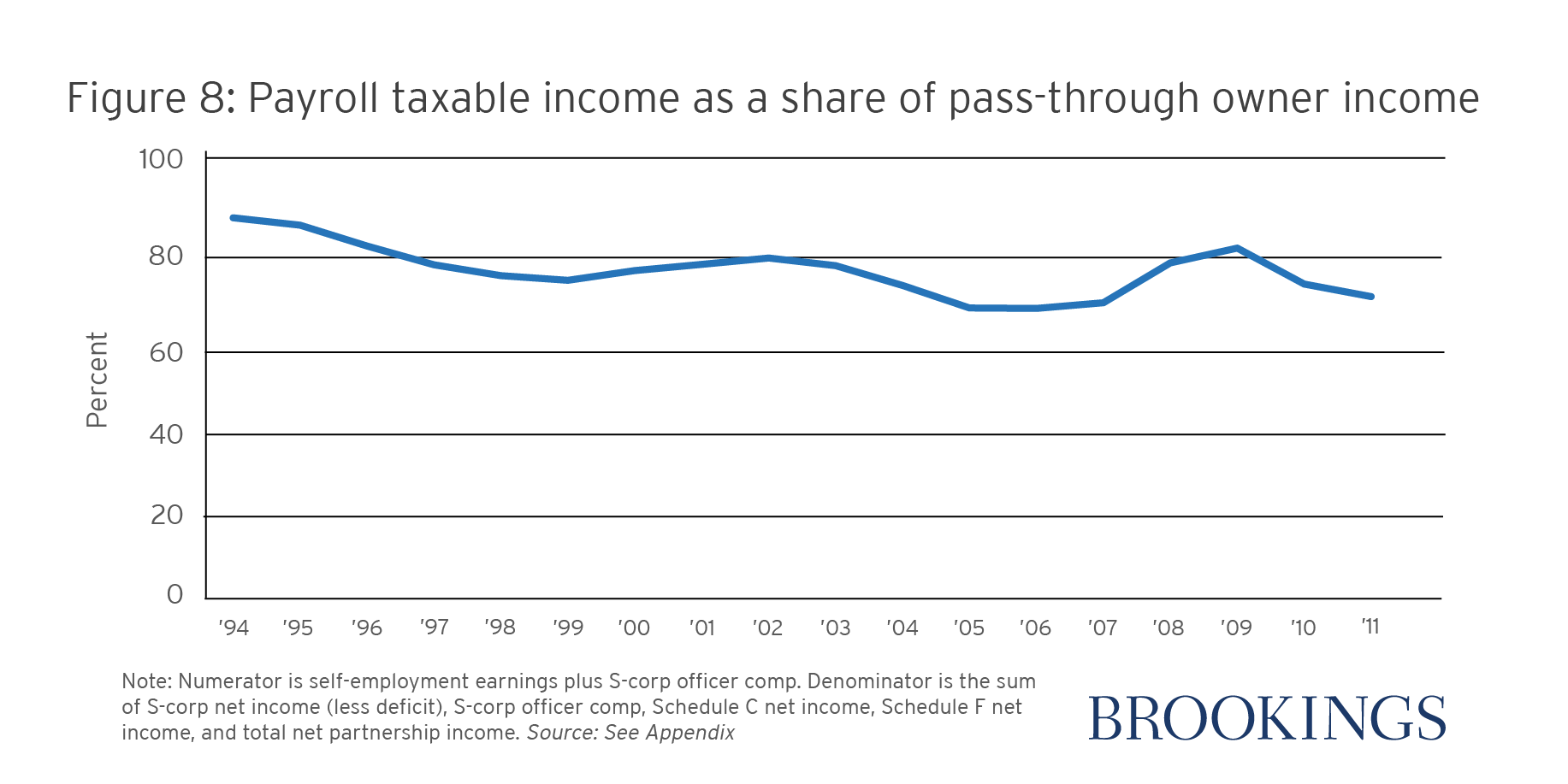

9 Facts About Pass Through Businesses

9 Facts About Pass Through Businesses

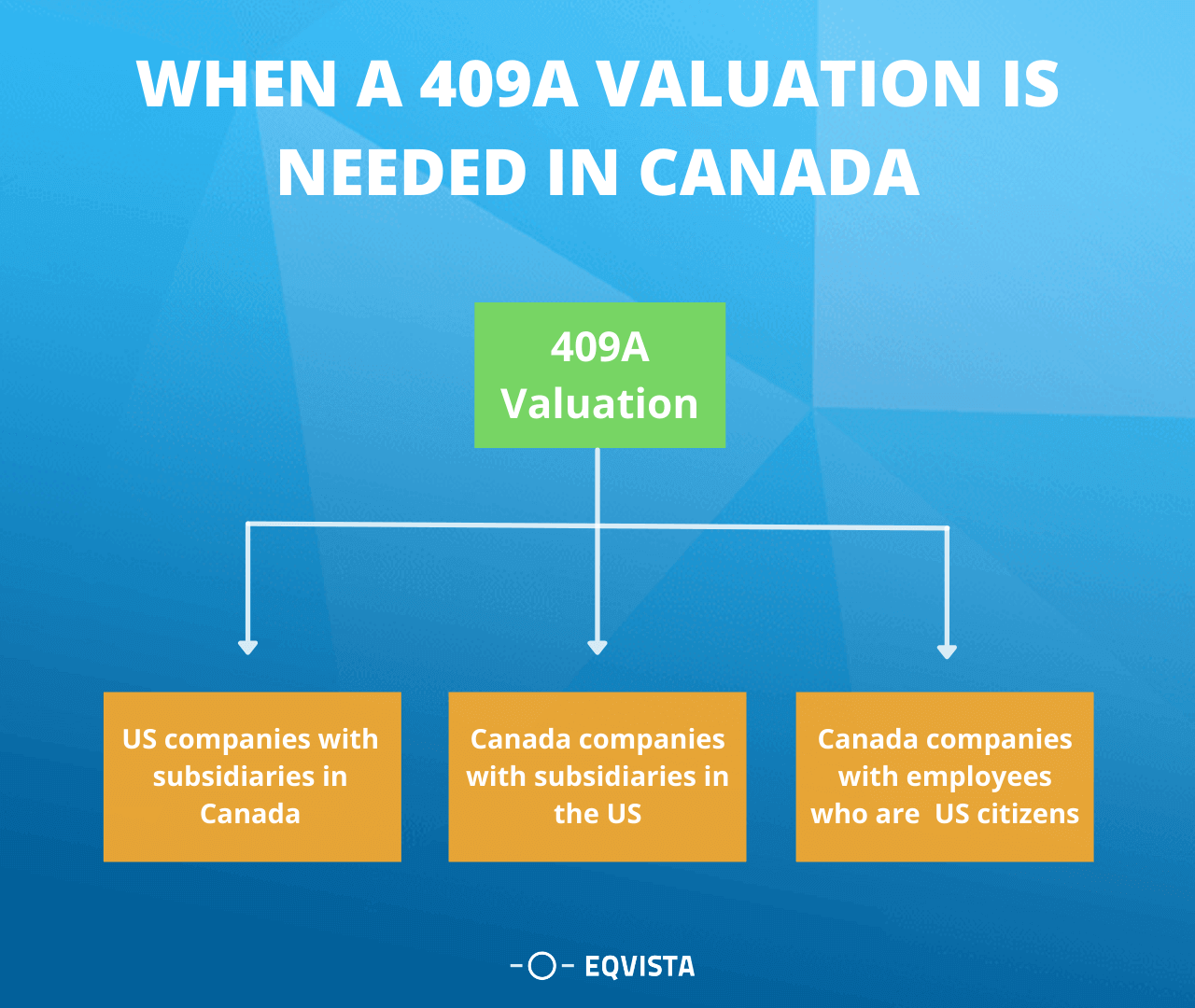

409a Valuation In Canada Eqvista

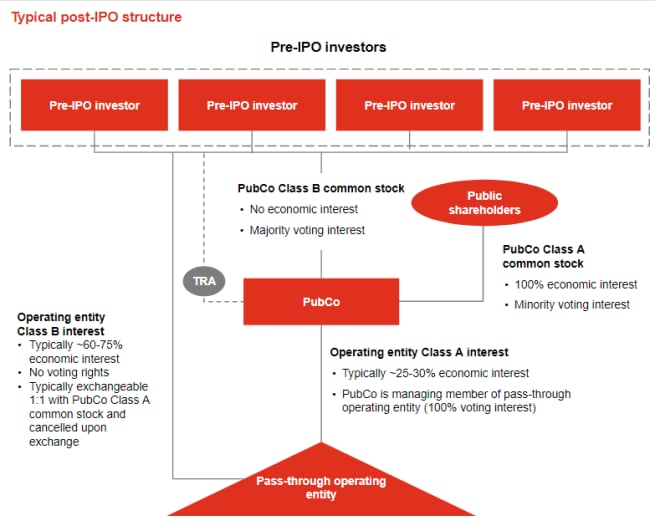

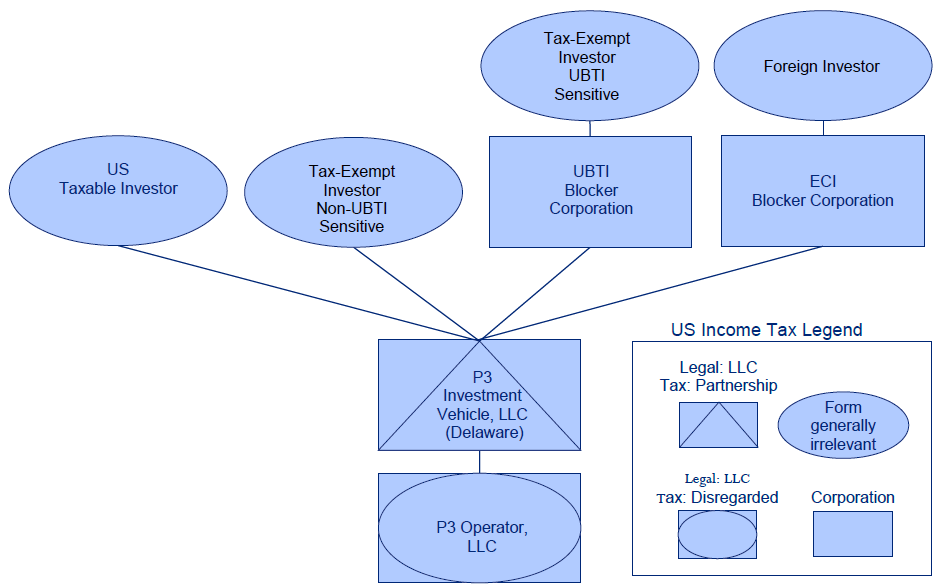

Fhwa Center For Innovative Finance Support P3 Toolkit Publications Reports And Discussion Papers

Double Taxation Of Corporate Income In The United States And The Oecd

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Llc Vs Corporation What Is The Difference Between An Llc And A Corporation Mycorporation

Biotalent Canada Introduces National Talent Strategy To Address Bio Economy Skills Shortage Business Wire

Pass Through Entity Definition And Types To Know Quickbooks

How To Form An Llc Advantages Disadvantages Wolters Kluwer

U S Canada Cross Border Taxation For Canadian Businesses Cpa